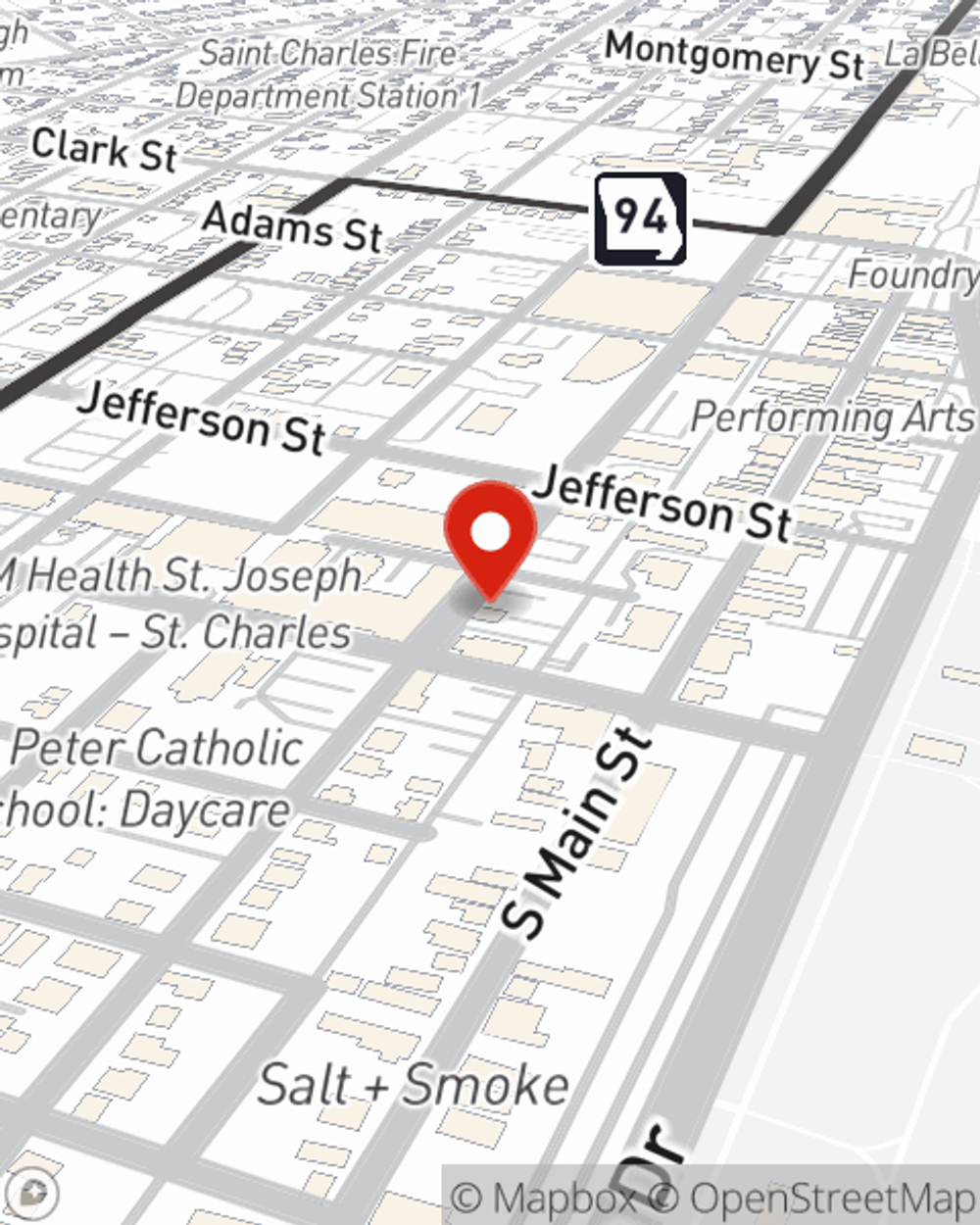

Auto Insurance in and around St Charles

Auto owners of St Charles, State Farm has you covered

Take a drive, safely

Would you like to create a personalized auto quote?

Insure For Smooth Driving

You've got the automobile. Now it's time to switch gears and choose the right coverage.

Auto owners of St Charles, State Farm has you covered

Take a drive, safely

Auto Coverage Options To Fit Your Needs

Whether you're looking for dependable protection for your vehicle like liability coverage, emergency road service coverage and collision coverage, or fantastic savings options like Steer Clear® and Drive Safe & Save™, State Farm can help. State Farm agent Kevin Pierce can help you choose which unique options are right for you.

When accidents put you off road, coverage from State Farm can help. Contact agent Kevin Pierce to find out how you can benefit from State Farm auto insurance.

Have More Questions About Auto Insurance?

Call Kevin at (636) 949-2244 or visit our FAQ page.

Simple Insights®

Obtain an electronic proof of insurance card

Obtain an electronic proof of insurance card

Having an electronic proof of insurance, also known as a digital ID card, makes 24/7 access to all your insurance information simple.

Kevin Pierce

State Farm® Insurance AgentSimple Insights®

Obtain an electronic proof of insurance card

Obtain an electronic proof of insurance card

Having an electronic proof of insurance, also known as a digital ID card, makes 24/7 access to all your insurance information simple.