Recreational Vehicles Insurance in and around St Charles

Calling all van camper owners in St Charles!

Protect your home sweet camper van.

Don't Let The Unexpected Camp Your Style

You can help protect your recreational vehicle with State Farm's Personal Price Plan. Whether going throughout the state or across the country, State Farm can help make sure your "Rainbow Chaser" is ready for the road ahead.

Calling all van camper owners in St Charles!

Protect your home sweet camper van.

There's No Place Like Home (or Your Home On Wheels)

Whether you're a fan of long weekend getaways in MO or extended roaming off the grid, protect your motorhome with insurance. With coverage for common risks like fire and theft, plus accident-related costs such as bodily injury to yourself and others — even while it's in storage — investing in a State Farm recreational vehicle policy from Kevin Pierce is essential to helping you enjoying life on the open road.

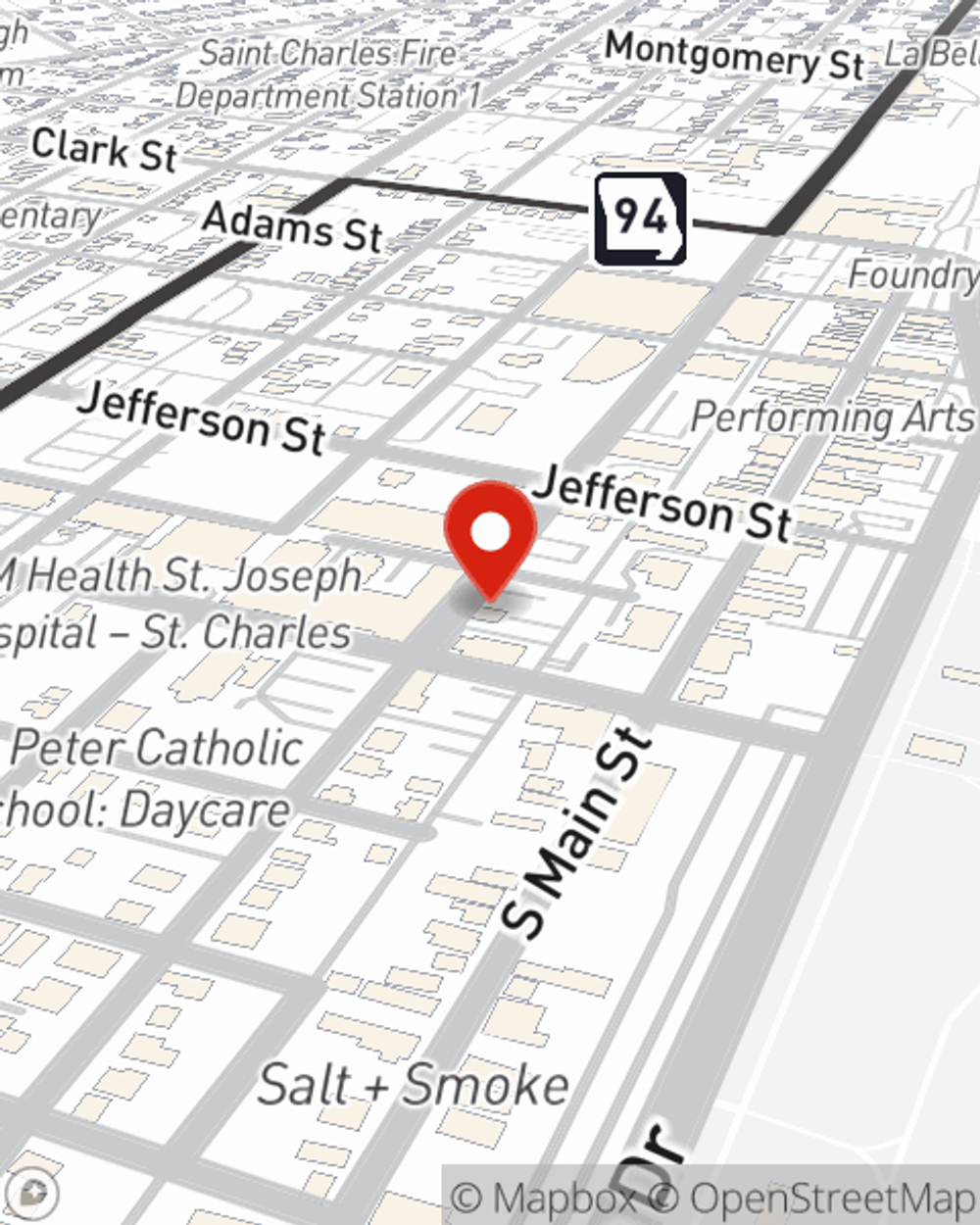

So if you and your motorhome are ready for coverage from the largest auto insurance provider in the U.S., just visit agent Kevin Pierce's office today!

Simple Insights®

What to know before buying an RV

What to know before buying an RV

You may be ready to buy an RV, and they come in many shapes and sizes. How do you ever decide? Start by checking out the following questions.

Camping safety made simple

Camping safety made simple

A camping trip is a great way to get in touch with nature. Setup your campsite & secure your belongings with the help of these camping safety tips.

Kevin Pierce

State Farm® Insurance AgentSimple Insights®

What to know before buying an RV

What to know before buying an RV

You may be ready to buy an RV, and they come in many shapes and sizes. How do you ever decide? Start by checking out the following questions.

Camping safety made simple

Camping safety made simple

A camping trip is a great way to get in touch with nature. Setup your campsite & secure your belongings with the help of these camping safety tips.